Trading

End-to-end transaction capability for environmental commodities—integrated analytics, venue access, and post-trade operations in one workflow.

ECMTerminalbringstransparencyandefficiencytoenvironmentalcommoditytransactions.Real-timepricing,counterpartyaccess,andintegratedanalyticssupporteverystageofthetradinglifecycle—frommarketscreeningtoregistrytransfer.

Deep Market Access

Connect to verified supply across registries, brokers, developers, and trading platforms through a single aggregation layer.

Integrated Analytics

Real-time pricing intelligence and transaction data built into every stage of the trading workflow.

Flexible Negotiation

Bilateral deal structuring for the non-standard terms environmental transactions require—volume splits, vintage specifications, delivery schedules.

Complete Post-Trade

Contract generation, registry coordination, settlement tracking, and audit-ready documentation through to completion.

Pre-Trade Analysis

Conviction before commitment. ECM Terminal delivers the market intelligence, counterparty data, and pricing analytics required to evaluate opportunities and build the case before you engage.

- Market Screening

- Counterparty Evaluation

- Pricing Intelligence

- Due Diligence Tools

OrderManagement

Order Tracking

Monitor bids, offers, and pending transactions in real time. Full lifecycle visibility from creation through completion.

Client Allocation

Manage orders across multiple accounts and mandates. Attribute activity to the right book.

Status Monitoring

Track order state, counterparty responses, and settlement progress. Nothing falls through the cracks.

Alerts & Notifications

Automated updates on order status changes, counterparty activity, and market movements relevant to your open positions.

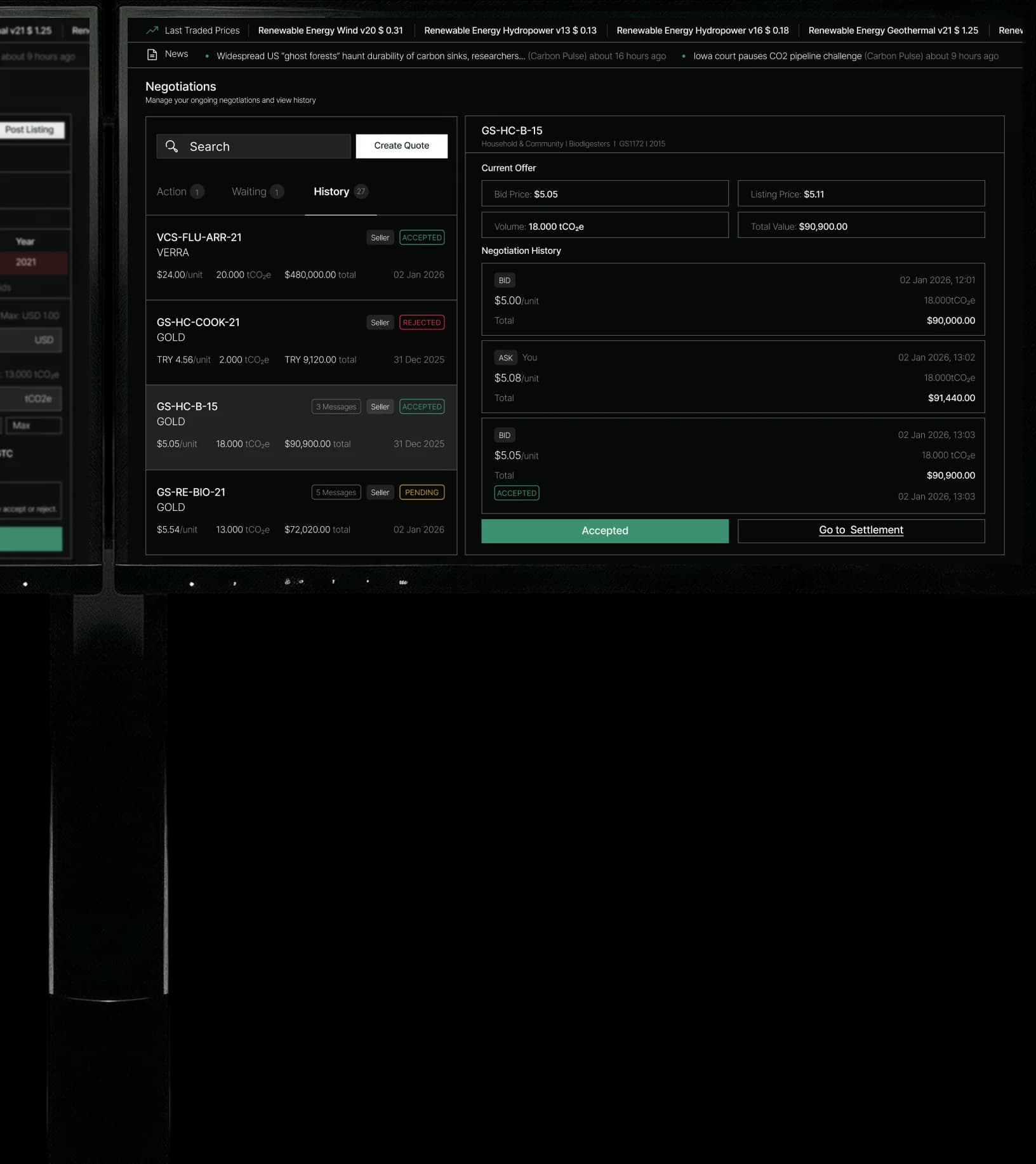

Negotiation & Execution

Environmental transactions are rarely standard. Volume splits, vintage specifications, delivery schedules, credit quality requirements. ECM Terminal supports the negotiation complexity these markets demand—bilateral, transparent, documented.

- Bilateral Negotiation

- Indicative & Firm Pricing

- Term Structuring

- Transaction Documentation

Access to Venues

Supply is fragmented across registries, broker platforms, developer networks, and OTC desks. ECM Terminal aggregates across external venues—bringing fragmented markets into one searchable, actionable view.

- Multi-Venue Aggregation

- Verified Supply

- Counterparty Network

- RFQ Distribution

Settlement & Transfer

Execution is half the job. ECM Terminal carries transactions through contract generation, registry transfer coordination, settlement confirmation, and audit-ready documentation. Post-trade operations that meet compliance standards.

Explore ECM Terminal

Request a Demo

Already a customer?

Get in touch with the support team for technical assistance, account questions, or platform guidance.

Contact supportFor enterprise pricing, custom integrations, or partnership opportunities.

ecm@erguvan.coHelp us connect you to the right person

TransformYourTradingOperations

JoinleadinginstitutionsusingECMTerminaltostreamlineenvironmentalcommodityworkflows.